Two questions for you.

- On a scale of 1 to 10: How much impact does the president have on the stock market?

Ok, did you come up with your answer?

- On a scale of 1 to 10: How much impact does the president have on the value of companies relative to their current stock price?

Ok, I lied. It was just one question phrased in two ways. Did you have two different numbers in your head?

When you really think about what the stock market is and how it is valued, what role do politics and specifically the president play?

Unless you’ve been under a rock for the last few months, you’ve heard about President Trump’s twitter-battles with China (tariffs) and the Federal Reserve (interest rates). Each 140 character tweet seems to impact the market, and it has surely been a bumpy ride. When speculation of a trade deal with China increases, the market has responded well. Is it because investors know the terms of the deal and they’re especially favorable? No. It’s because a deal means certainty. Put another way, it removes uncertainty. However, when Trump then throws up his (tiny) hands in frustration and the two countries go back to the drawing board, the market takes a dip. Up, down, up, down, it seems.

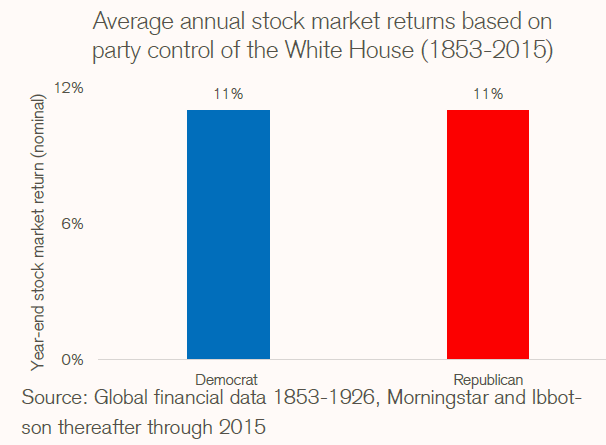

The stock market is a mysterious beast. If there’s one thing we know, is that market volatility is tied to ambiguity. It likes predictable results. So with the 2020 election approaching, what does that mean as an investor? Will markets do better with Republican in the White House or a Democrat?

Well, historically speaking, it doesn’t really matter:

This lends itself to a larger point. The stock market is made up of publicly traded companies. A stock price goes up or down based on what investors believe/calculate it to be worth. Micro-economic factors are those specific to a company. Did the CEO quit? Is the product catching on fire? Did they make a breakthrough? However, if entire industries increase or decrease in price, it is due to a macro-economic factor:

Macro-economic factors:

- Economics

- interest rates

- inflation

- employment

- Politics

- tax laws and regulations

- tariffs and trade deals

- Natural Disasters

- Market Psychology

- optimism or pessimism

Like trying to predict when the next big earthquake will hit, trying to predict the actions of world leaders (or potential ones, come election season) is not generally a rewarding or worthwhile task for investors. Politics are one factor of many. The actions of the President of the United States can have an impact, but so do the actions of the Chairman of the Federal Reserve (Jerome Powell, currently) and Microsoft CEO Satya Nadella. The President gets way too much credit when the economy does well, and way too much blame when it does poorly.

“I can’t think of a time when [macroeconomics] influenced a decision about a stock or a company.”

-Warren Buffett