It was no secret, people were anxious to welcome in 2021. The new year brought with it hope and a much needed turn-the-page moment to most everyone on the planet. Seeing friends and family, sporting events, in-person learning. The prospects for 2021 were glorious. Good riddance, 2020. But hold on one second… 2020 isn’t over when it comes to one very important thing: IRA contributions!

That’s right, you procrastinators out there still have until April 15th, 2021 to make your 2020 contributions to your individual retirement account (IRA) or Roth IRA. The maximum you can contribute for 2020 is $6k if you’re under 50, and $7k if you’re 50 or over.

Why Contribute?

- Use it or lose it. You only have from January 1, 2020 until April 15, 2021 to make your 2020 contributions. You can’t go back later in life and make up for prior years. With such a small limit of $6k, the key to long-term success is starting early and remaining consistent.

- Tax-free growth (Roth IRA) or at least tax-deferred growth (Traditional IRA). If you’re thinking, “tax free sounds better than tax deferred,” you would be right. If an IRA is that new car you’ve been looking at, a Roth IRA is the “Sport” version with the leather seats.

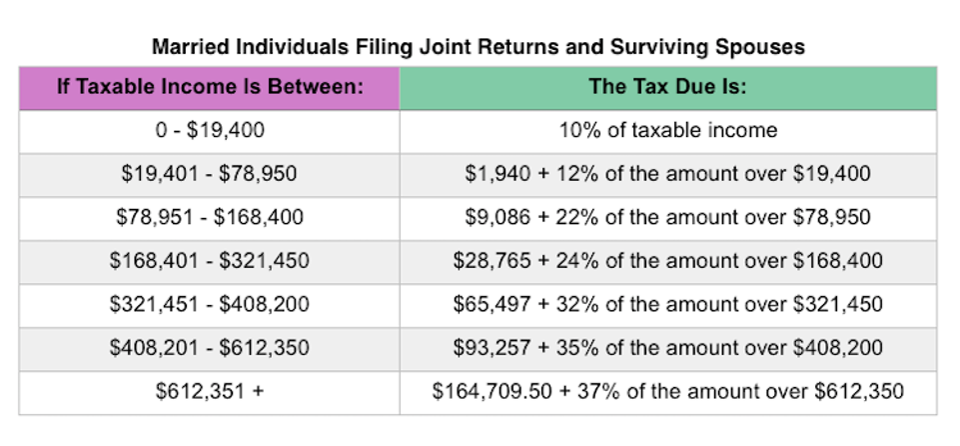

- With an IRA, you (or your heirs) will eventually be taxed on any dollars in the account that haven’t been taxed before. But, in the interim, you get the benefit of compounding returns as you don’t have to pay any capital gains taxes on the earnings as you go. If you contribute to your IRA from your checking account each year, those are after-tax dollars and won’t be taxed again. If you rollover your previous employer’s 401k, those are pre-tax dollars and will one day be taxed, in addition to the earnings in the account.

- In a Roth IRA, you contribute after-tax dollars and all growth within the account is tax-free as well. So even when you’re 80 and want to buy that bucket-list ticket to Mars, you can use your Roth IRA and won’t be taxed. Every penny in the account is yours, as long as you don’t withdraw earnings in the account before 59.5 (with some exceptions). Regardless of when you withdraw from your Roth account, every dollar you contribute is always yours, no penalties or taxes, ever. That’s because all contributions to a Roth IRA are made after-tax. Here’s a great Schwab summary for more info.

Depending on your modified adjust gross income, you may be ineligible to contribute directly to a Roth IRA. Before I provide the link to the chart of eligibility (ok, I just provided it), if you find yourself ineligible to make a full Roth contribution, you can always utilize what’s called a backdoor Roth conversion. It sounds more devious than it really is. You won’t end up on the latest Netflix documentary detailing white collar crimes for utilizing this strategy. The Roth IRA is probably younger than you, actually, as it wasn’t created until 1998. Point being, the kinks are still being worked out, and you’re not wrong for thinking, “these rules make no sense.” For a while, there was a debate regarding if backdoor roth conversions were a legal loophole in the system. The debate is over, they are legal. To make a backdoor conversion, you contribute first to a traditional IRA (ideally with a zero balance) and then move the money (convert) to your Roth IRA. If you had only after-tax money in your IRA, the conversion is a tax-free event. If there is any pre-tax money in your IRA, that complicates the picture a bit and will trigger some amount of tax.

You Made the Contribution… Now what?

Investing within your IRA or Roth IRA: With these accounts being pegged for retirement, they probably have a pretty long time horizon for you compared to your other investment account(s). With a long time horizon and tax-deferred or tax-free growth, investors often find it makes sense to hold their more “growthy” assets in these accounts. As an example, if an investors entire portfolio is weighted to 70% stocks and 30% bonds, their Roth IRA may be weighted to 85% stocks and 15% bonds, while their individual (taxable) account may be closer to 60% stocks and 40% bonds. It would depend on the amounts in each account to arrive at a total weighted average of 70% stocks. As investors get older and closer to possibly using their Roth assets, they tend to scale back on the risk and reward, instead finding more value in stability.

If you have extra cash on hand and are looking to build your retirement nest egg, take advantage of your IRA or Roth IRA contributions each year. Your wall calendar may say it is 2021, but there’s still time left to make 2020 better!